How To Become A Independent Contractor In Ct

Independent contractors need to arrange for their own training and cover the costs.

How to become a independent contractor in ct. While home improvement and new home construction contractors must be registered to do business in Connecticut certain types of skilled work requires the additional training experience and education that professional licensing helps to ensure. The qualifications that you need to start working as an independent contractor courier include a high school diploma and driving skills. Become an Independent Nurse Contractor Become a Independent Nurse Contractor by getting an ADN or BSN and provide self-employed care.

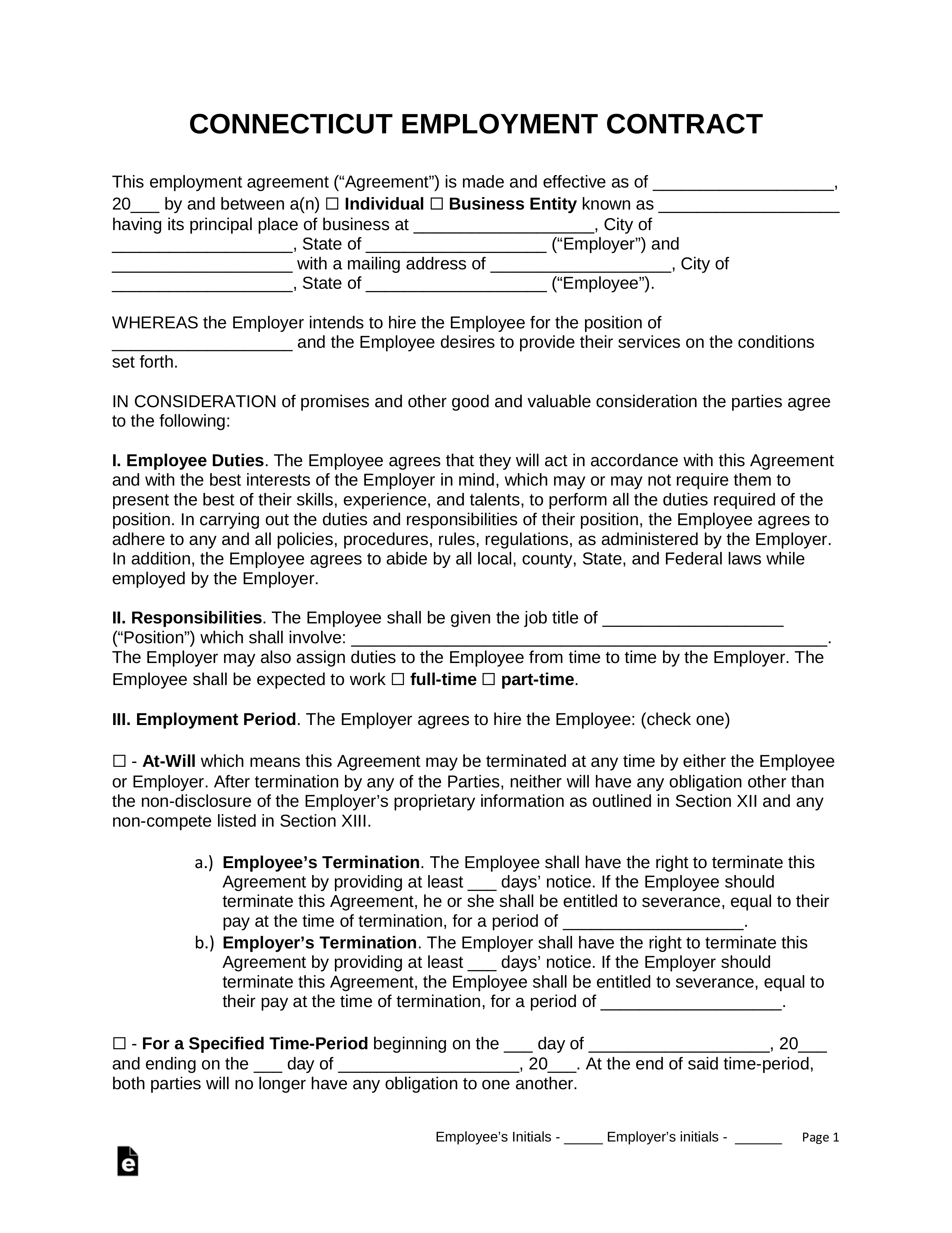

How to Become an Independent Contractor Courier. However they do seek drivers with a clean driving record. If you have questions about how to determine whether a worker should be classified as an independent contractor or an employee in Connecticut consider contacting a law firm with extensive experience in.

Do I need more education to be an independent nurse contractor. Most employers provide training for employees whether its on-the-job training or developing new skills. The individual must be free from direction and control work independently in connection with the performance of the service both under his or her contract of hire and in fact.

Ad No Pass No Pay Guarantee. As an independent contractor you often set your own schedule and decide how many hours you will work. An Independent Nurse Contractor is their own boss working on a contractual basis instead of being employed directly by a healthcare facility.

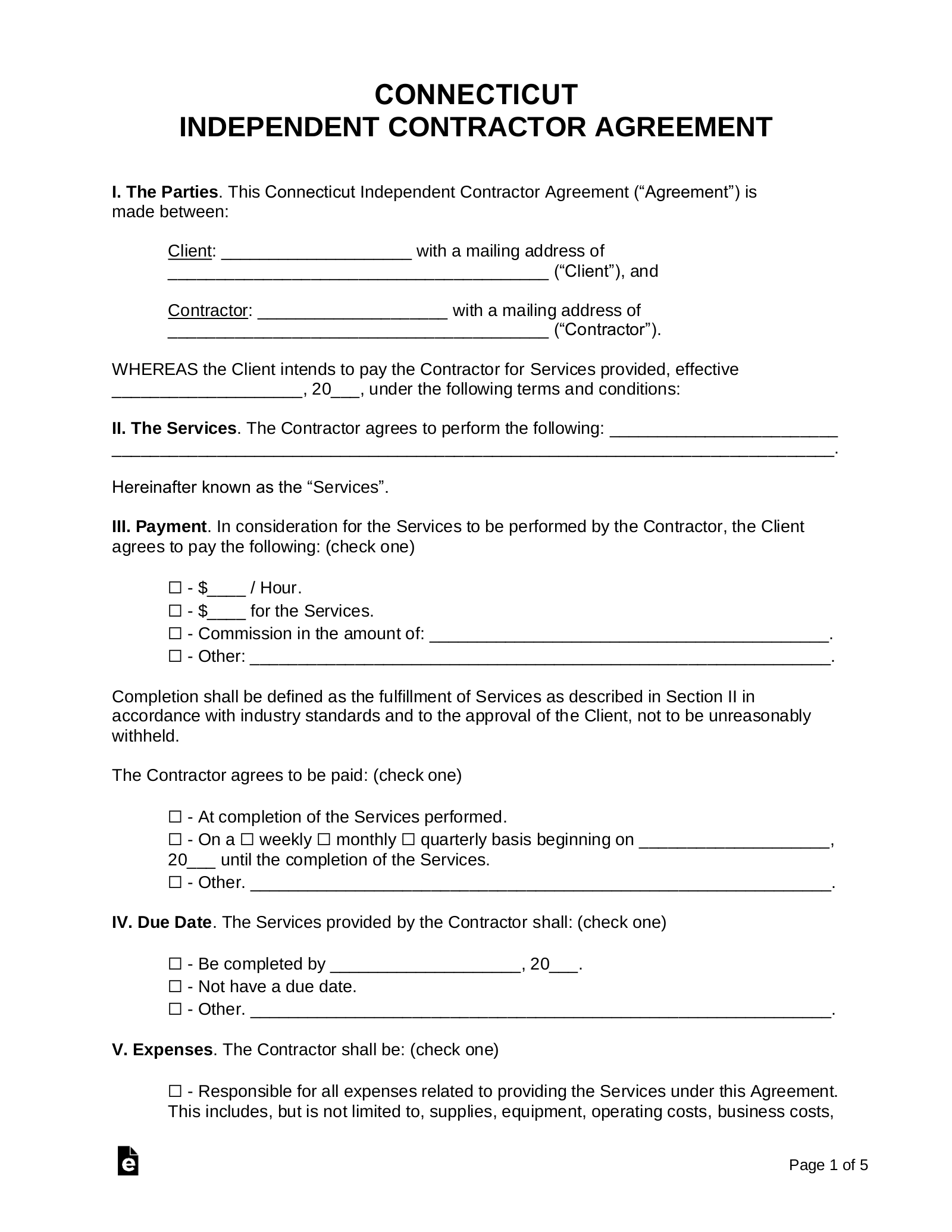

If youre an independent contractor select from the following links for information about opportunities with the FedEx family of companies. You need to be an RN. How to Become an Independent Contractor 3 INTRODUCTION An independent contractor is a person business or corporation that provides goods or services to a hiring company under the terms of a contract.

Ad No Pass No Pay Guarantee. Why should you be an independent contractor and not an employeeIndependent contractors in Canada have many more tax write-offs available to them and a much. Labor and employment law firm Kainen Escalera McHale include the 20-factor test in their free employers guide to distinguishing independent contractors from employees.